IRS 1040 - Schedule D 2024-2025 free printable template

Show details

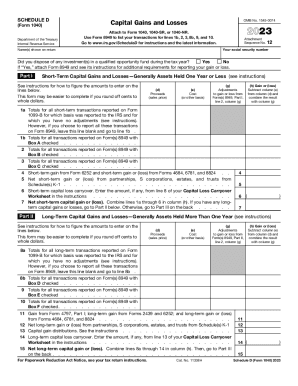

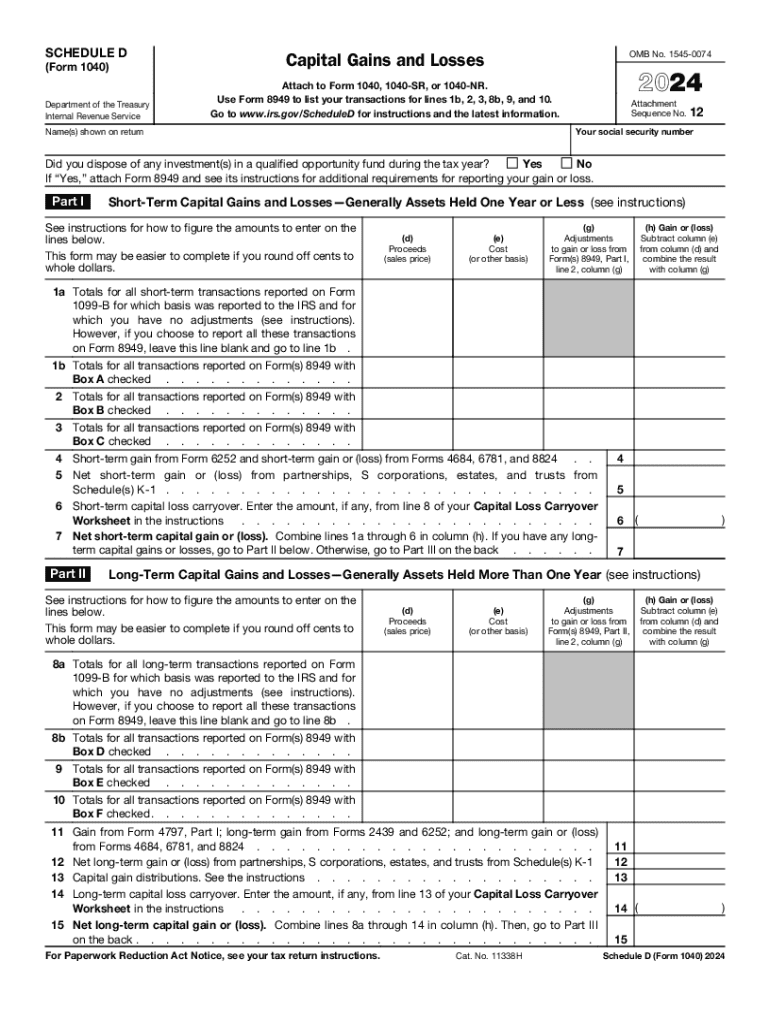

Don t complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 11338H Schedule D Form 1040 2024 Page 2 Summary Combine lines 7 and 15 and enter the result. SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service Capital Gains and Losses OMB No. 1545-0074 Attach to Form 1040 1040-SR or 1040-NR. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10....

pdfFiller is not affiliated with IRS

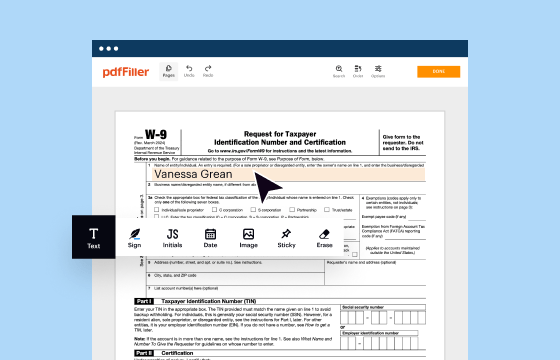

Understanding and Utilizing IRS 1040 - Schedule D

Detailed Steps to Edit Your Schedule D

Guide to Completing the Schedule D Form

Understanding and Utilizing IRS 1040 - Schedule D

The IRS 1040 - Schedule D is a crucial form for taxpayers involved in capital asset transactions, such as stocks, bonds, and real estate. It enables individuals to report their capital gains and losses, thereby impacting their overall tax liability. Successfully completing Schedule D helps taxpayers ensure compliance with IRS regulations and potentially reduce taxable income through effective management of investment gains and losses.

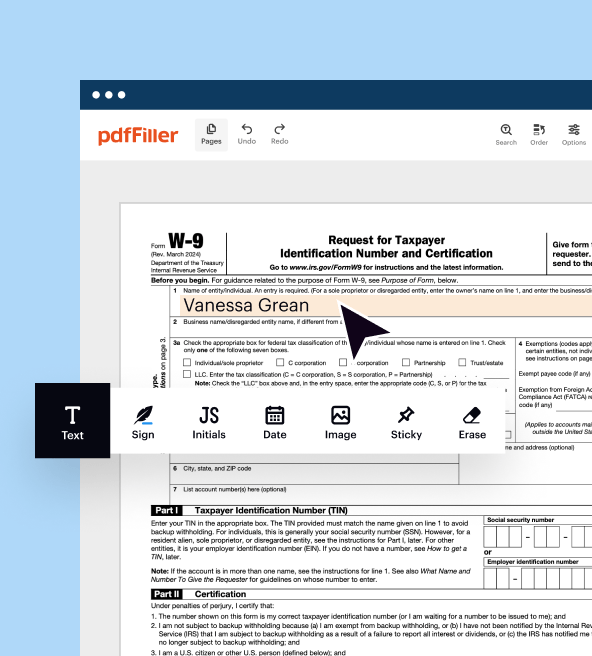

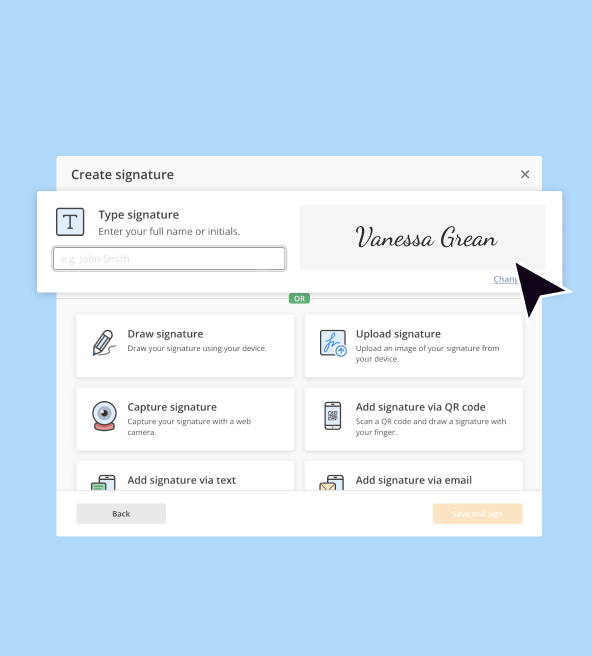

Detailed Steps to Edit Your Schedule D

To accurately edit and finalize your IRS 1040 - Schedule D, follow these structured steps:

01

Gather relevant documentation related to your capital gains and losses, such as transaction records and brokerage statements.

02

Access the current year’s Schedule D form from the IRS website or your tax preparation software.

03

Enter your personal information and confirm it matches your IRS Form 1040 details.

04

Document all sales of capital assets, categorizing them into short-term and long-term sections based on the holding period.

05

Calculate total gains and losses, ensuring to include any adjustments required, such as carryover losses from previous years.

06

Review for accuracy and completeness before submission.

Guide to Completing the Schedule D Form

Completing the IRS 1040 - Schedule D involves several key steps:

01

Identify the correct form for your filing status—individuals typically use Form 1040.

02

Section I handles short-term gains and losses, while Section II focuses on long-term transactions, each requiring specific details about each asset sold.

03

For each transaction, fill in the date acquired, the date sold, proceeds, cost basis, and the resulting gain or loss.

04

Summarize your totals in part III, ensuring to transfer appropriate figures to your IRS Form 1040.

Show more

Show less

Recent Developments Regarding IRS 1040 - Schedule D

Recent Developments Regarding IRS 1040 - Schedule D

Stay informed on the latest changes impacting Schedule D. Recent updates include:

01

Adjustments to gain thresholds that influence the capital gains tax rates.

02

Changes to wash sale rules, which affect how investors report losses on stock sales.

03

New reporting requirements for cryptocurrency transactions that may alter how gains are calculated.

Key Information About IRS 1040 - Schedule D

What is IRS 1040 - Schedule D?

Purpose of IRS 1040 - Schedule D

Who Needs to File This Form?

Criteria for Exemptions

Components of IRS 1040 - Schedule D

Filing Deadline for Schedule D

Comparing IRS 1040 - Schedule D to Related Forms

Transactions Covered by Schedule D

Number of Copies Required for Submission

Penalties for Non-compliance with Schedule D

Information Required to File Schedule D

Other Forms That May Accompany Schedule D

Where to Submit IRS 1040 - Schedule D

Key Information About IRS 1040 - Schedule D

What is IRS 1040 - Schedule D?

IRS 1040 - Schedule D is a supplemental form that taxpayers must file with their annual return to report capital gains and losses. It details the sale of assets and calculates the overall impact on taxable income.

Purpose of IRS 1040 - Schedule D

The primary purpose of Schedule D is to report the sale or exchange of capital assets, which may ultimately affect your tax liability by potentially qualifying some profits for lower long-term capital gains rates.

Who Needs to File This Form?

Individuals who have sold or exchanged capital assets during the year, including stocks, bonds, real estate, or collectibles, must complete Schedule D. This applies whether the transactions yielded a profit or a loss.

Criteria for Exemptions

Exemptions apply in specific scenarios:

01

If your total income is below $50,000, you may not need to report certain gains.

02

Transactions made in specific retirement accounts (like IRAs) are generally exempt.

03

Casual sales of personal property, such as a used car sold for less than your cost, may not require reporting.

Components of IRS 1040 - Schedule D

Schedule D comprises several key components, including:

01

Short-Term Capital Gains and Losses section

02

Long-Term Capital Gains and Losses section

03

Summary of total gains and losses, transfers to the main Form 1040, and Schedule 1 if applicable.

Filing Deadline for Schedule D

The deadline for submitting IRS 1040 - Schedule D aligns with the annual tax filing deadline, typically April 15th. For 2023, ensure to check for any extensions or specific state mandates that may affect your local filing dates.

Comparing IRS 1040 - Schedule D to Related Forms

When considering your tax filing needs, note the differences between Schedule D and:

01

Schedule 1: for reporting additional income and adjustments to income.

02

Form 8949: for detailed reporting of each individual transaction before summarizing on Schedule D.

Transactions Covered by Schedule D

Schedule D covers a diverse range of transactions, including:

01

Sale of stocks, bonds, and investment property

02

Real estate transactions not classified as primary residences

03

Sales of collectibles, such as art, coins, or antiques.

Number of Copies Required for Submission

Typically, only one copy of IRS 1040 - Schedule D is required for your tax return submission, which is filed with your Form 1040.

Penalties for Non-compliance with Schedule D

Failing to file IRS 1040 - Schedule D can result in multiple consequences, such as:

01

A penalty of 5% of the unpaid tax required for each month the form is late.

02

Interest accruement on unpaid tax liabilities, which compounds over time.

03

Potential audit risks due to discrepancies in reported income.

Information Required to File Schedule D

When filing Schedule D, prepare to provide:

01

Your identification details and Social Security number.

02

A detailed list of all transactions involving capital assets.

03

Proof of purchase and sale amounts to establish cost basis and reporting compliance.

Other Forms That May Accompany Schedule D

Other forms often required alongside Schedule D include:

01

Form 8949 for detailing each transaction.

02

Form 4797 for reporting sales of business property.

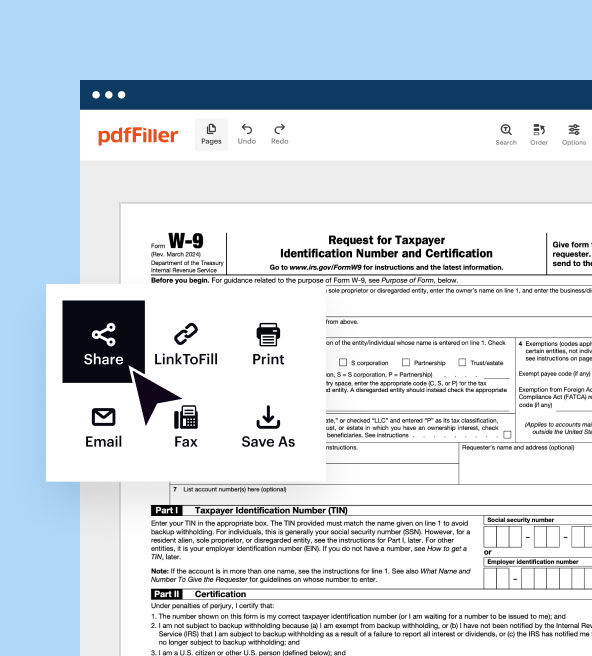

Where to Submit IRS 1040 - Schedule D

Submit your completed IRS 1040 - Schedule D along with Form 1040 to the designated IRS address outlined in the filing instructions based on your location. Check the IRS website for the latest submission addresses to ensure proper handling of your forms.

Completing IRS 1040 - Schedule D accurately is essential for managing your investment income tax liabilities. For assistance or to start using online tax platforms like pdfFiller to prepare your forms, take the next steps in ensuring a smooth filing process.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I love that it creates fillable forms for me. My handwriting is terrible.

it has been very helpful so far in my divorce case

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.