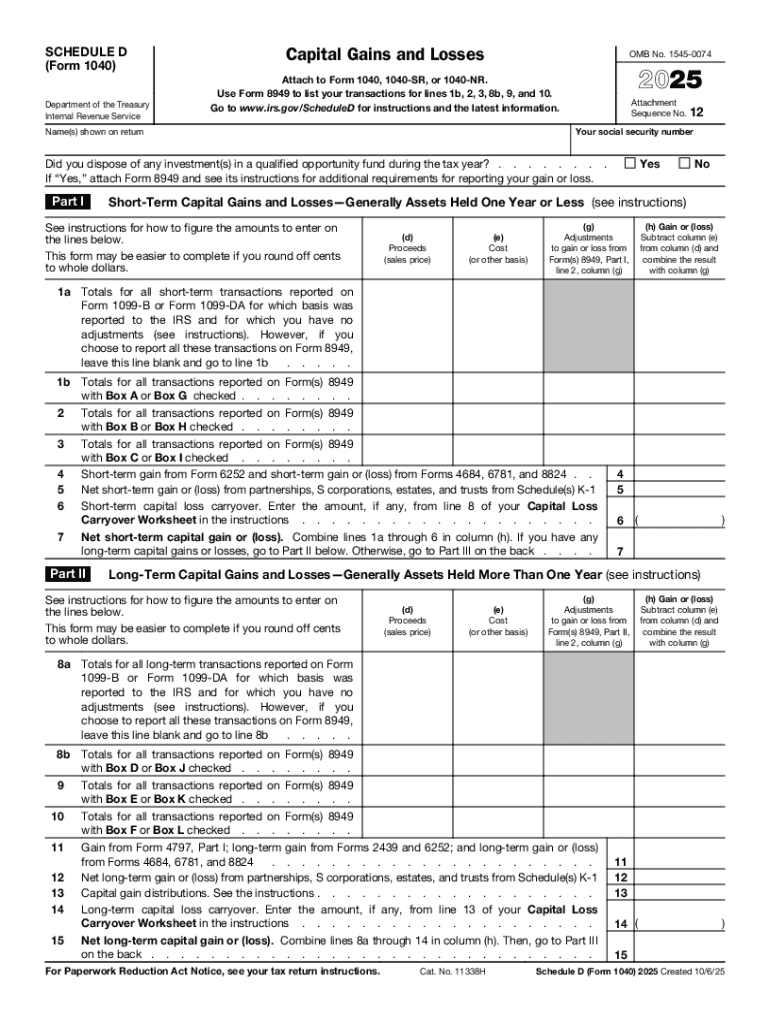

IRS 1040 - Schedule D 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule D

How to edit IRS 1040 - Schedule D

How to fill out IRS 1040 - Schedule D

Latest updates to IRS 1040 - Schedule D

All You Need to Know About IRS 1040 - Schedule D

What is IRS 1040 - Schedule D?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule D

What should I do if I need to amend my IRS 1040 - Schedule D after filing?

To amend your IRS 1040 - Schedule D, you will need to fill out Form 1040-X, which is the amendment form for individual tax returns. Ensure that you include any necessary changes to your Schedule D. If you e-filed originally, check the guidelines about submitting the amended form, as different rules apply for corrections.

How can I verify the status of my IRS 1040 - Schedule D submission?

You can verify the status of your IRS 1040 - Schedule D submission by using the IRS 'Where’s My Refund?' tool, available on their website. This service provides updates about your filing status and can alert you to any issues during processing, such as rejection codes if filing electronically.

What are common mistakes to avoid when filing IRS 1040 - Schedule D?

Common mistakes when filing the IRS 1040 - Schedule D include miscalculating gains and losses, not reporting all transactions, and failing to include all required information. It's crucial to double-check your entries and consult documentation to ensure accuracy and compliance.

Is it secure to e-file IRS 1040 - Schedule D, and what precautions should I take?

E-filing your IRS 1040 - Schedule D is generally secure, as reputable e-filing systems use encryption and data security measures. However, to enhance privacy, ensure you use strong passwords, regularly update your software, and only file through trusted platforms.

See what our users say